It is the time of year when you can challenge your property taxes, but what are the ramifications for challenging your property taxes, during the peak of the pandemic and high water? I’ll address these issues in this story.

Frankly, the matter is still up in the air, so we do not have all the answers at this time; but we plan to update information to this story in May and for as long as it becomes available.

If you have questions you can post them on this story, and we will try to find the appropriate answers. If you have answers to the questions posed, we’d like to hear from you, as well.

Here are some questions I’ve received:

What happens with COVID-19 and property tax grievance?

As of this writing, assessors are doing what they can from home. Most (Hammond, Clayton, Alexandria and Cape Vincent) report that everything is on schedule at this time. We suggest you check your town website for updates as well as assessors' emails.

Will property taxes have to be paid on time?

The answer I have received so far, is yes. They will have to be paid on time. I will update this if I hear otherwise. Again, check your Town's websites.

Will there be a reduction for those who can't come to the River as they are following NY State or their state's directions (don't travel to cottage country)?

The answer I have received to this so far is no. I will update if I hear other-wise.

Can I have a session with the Assessor to review my assessment?

Not in person at this point. Most town offices are closed. My suggestion is to contact your Assessor via email. And don’t wait until the last minute, as they likely will be swamped. They don’t have all the resources at home they have in their office. But you should be able to email your data and they may work with you, to make adjustments, just as they have in the past.

Will there be Board of Assessment Review hearings?

The feedback I’ve received so far is they plan to have them as scheduled, but they may be via video conference. Check your town website for details.

Will there be (SCAR) Small Claims Assessment Review hearings?

This is too early to tell, but so far, I think the schedule will be maintained, but the hearings may be via video conference. These hearings don’t take place until late August or early September, so it is too early to tell.

The bottom line is that the entire process will go on as scheduled, as far as I know at this time. It may simply need to be done via e-mail, phone and video conferencing.

Check back for updates.

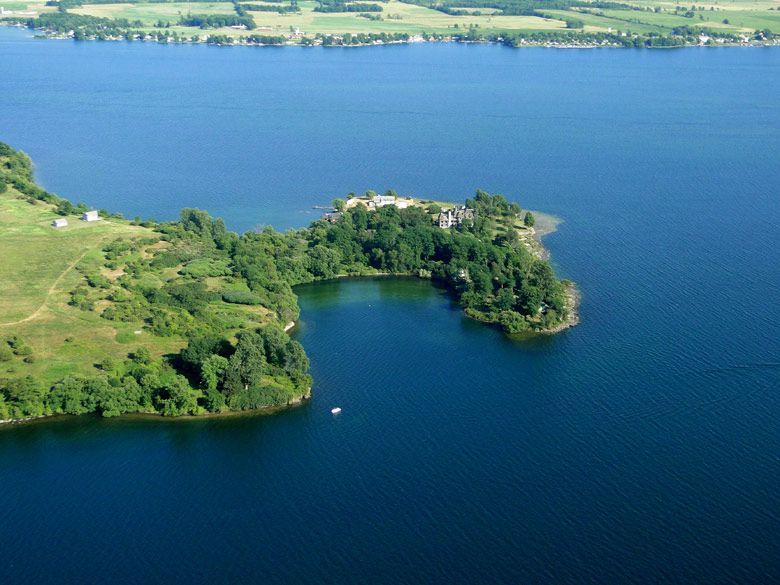

What impact does high water have on grievance?

Can taxpayers get a reduction for last year's high water and flooding?

The feedback I have received is that there is sympathy for high water, but no official policy. So far, there is very little sales data to go by, to determine the over-all impact. High water will impact some properties more than others. So, it should be addressed on a case by case basis.

My recommendation as well as the recommendations of each Town Assessor's Office is to take a lot of photos. The taxpayer must meet the burden of proof. So, the more information you have to demonstrate the impact of high water on your property, vs comparable assessments the better.

Here is an example of how I, as a State Small Claims Assessment Review Hearing Officer, handled a high-water case in the past:

Petitioner demonstrated his property had flooded significantly and repeatedly. Other properties that would normally be considered comparable, were not flooded. Because the property had flooded and it is clear it will continue to flood, I reduced the assessment significantly and indicated if it gets to the point where it no longer floods, the assessment can be raised at that time.

What helped the taxpayer win that case was his extensive photos. Once I saw the photos, it was obvious the taxpayer had a legitimate case. It was simply a matter of common-sense documentation of the circumstances of the property, in comparison to other comparable properties.

Bottom line is, as a Hearing Officer, I’m looking to find fair market value. If a property floods every year, what is the fair market value?

Will the State legal action to IJC make a difference?

I do not know of any policy issues, as it pertains to high water assessments. If I find it, I will update this page. If you have high water, I suggest you document your circumstances, in great detail and contact your Assessor via email. If you don’t get satisfaction, you can follow the grievance process which I will detail below.

Grievance process during COVID Pandemic and High Water:

Contact your Assessor via e-mail. Be prepared and have your data and photos ready, so you can make it obvious to the Assessor, or any reasonable person, that you have a case. If you make it obvious, the Assessor may make an adjustment on the spot. Many times, I have pointed-out information unknown to the Assessor, and the Assessor simply made the correction.

If you don’t get satisfaction from the Assessor, file a Board of Assessment Review (BAR) petition and check your Town website for scheduling of the hearing.

From what I’ve heard, BAR hearings may be done by phone or video conference. Towns will be updating their website, with instructions, as Grievance Day approaches and they know better, what they plan to do under these trying circumstances.

Instructions from the state website on how to file a Board of Assessment Review petition:

https://www.tax.ny.gov/pit/property/contest/grievproced.htm

Link to the Board of Assessment Review PDF RP-524 Petition form:

https://www.tax.ny.gov/pdf/current_forms/orpts/rp524_fill_in.pdf

If you don’t get satisfaction from the Board of Assessment Review, don’t get discouraged. Typically, the Board of Assessment Review is a five-person panel, of townspeople, who review your case. It is a committee, and sometimes you don’t get satisfaction there.

I have lost many times at BAR hearings, only to prevail at the (SCAR) Small Claims Assessment Review level.

Many-times the Board of Assessment Review hearing has helped me see that there were inadequacies in my argument, and it helped me to correct my argument, befor I went to SCAR. So even if you lose, petitioning the Assessor and the BAR, you can win at SCAR.

SCAR hearings are what they call “de novo” (literally 'of new') is a Latin expression, used in English, to mean 'from the beginning', 'anew'.

Nothing that happened at the BAR hearing, or with the Assessor, will be addressed.

You make your arguments from scratch. If you have the data and you are in the right, you have a very good chance at winning at one of the levels.

(SCAR) Small Claims Assessment Review hearing officers are contracted and work for the State. Cost is $30. To qualify as a hearing officer, you need to be a former Assessor, an Appraiser, a Lawyer or a Real Estate Broker.

Instructions from New York State website to file a Small Claims Assessment Review Petition:

http://ww2.nycourts.gov/litigants/scar/petitions.shtml

Petition form and More Information:

https://www.nycourts.gov/LegacyPDFS/LITIGANTS/scar/New%20Petition%20ONYC%20Form%202019.pdf; For more information see: www.ThePropertyTaxGuy.com

Good luck, and check back for updates.

If you have any questions, feel free to call me: Mike Franklin 315-876-2262.

AUTHOR'S NOTE written 04/16/20: I noted the mention in the excellent article written by my Canadian counterpart Peter Van Sickle that many will be anxiously watching for sales of cottages to see a new market trend as a result of the high water. This was also mentioned by two of the Assessors I spoke to regarding this story. My suggestion that while waiting for sales ...... a legitimate valuation method is also ....watching for what things have NOT sold for. If a comparable property has been on the market for a year or more and has not sold....I believe that list price is indicative of what it is NOT worth. When this market (The US side) is down it tends to stagnate. So there are few sales to go by. So, do you only wait for a good market for sales? The market is the market on the date specified by the assessing authority.... and even if there are few or no sales..... it is still a market. And demonstrating what comparable properties have NOT sold for is perfectly valid in my view.

By Michael R. Franklin

Michael R. Franklin is a (SCAR) Small Claims Assessment Review Hearing officer for eight counties of the 4th and 5th Judicial Districts of the New York State Unified Court System. Mike also has extensive experience, successfully representing property owners in the assessment grievance process, and he is a Licensed New York State Real Estate Broker. See www.ThePropertyTaxGuy.com

Posted in: Volume 15, Issue 4, April 2020, News article

Please click here if you are unable to post your comment.