Thousand Islands Watershed Land Trust Seminar

by: Elspeth Naismith

The Thousand Islands Watershed Land Trust (TIWLT) hosted a seminar at Holy Trinity Church, Athens, ON, on the morning of Saturday June 22nd. About 60 people gathered to hear Don Ross, President of the Board of Directors, and Calder Schweitzer, TIWLT Executive Director, speak about land trusts, how they work, why they’re critical for the environment and climate, and how landowners can utilize land trusts to conserve their properties. The morning concluded with a panel discussion.

Don opened the seminar by speaking briefly about the history of TIWLT, the various land trusts and associations in the region, including the Ontario Land Trust Alliance, which supports and provides resources to all of the Land Trusts in Ontario in support of their work in their home communities. These lands include current farmlands, marshlands, and Indigenous areas, which are protected and managed specifically by Indigenous Land Trusts, a closely related but slightly different type of organization. Don emphasized that encouraging interactions between, and cooperation among, these entities is key to protecting and conserving these lands.

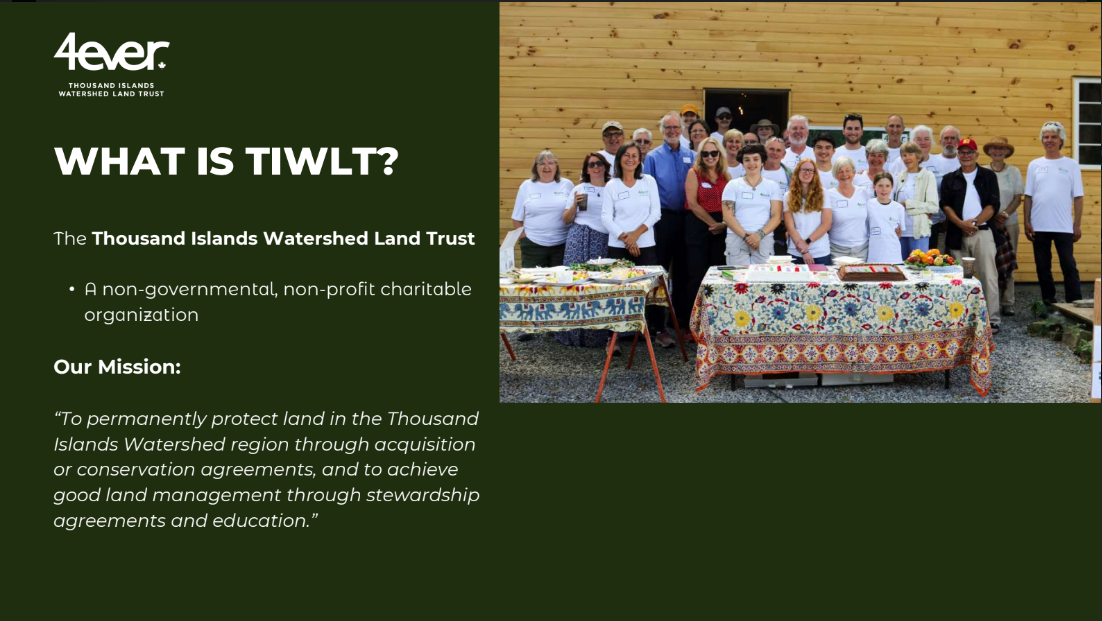

TIWLT’s Mission

Next, Calder spoke about TIWLT’s mission, which is to conserve lands in the region and to find long term solutions to protect key lands. Their focus is the Thousand Islands Watershed region, which is ecologically unique. It is a major migratory path, and is home to 25% of the Species At Risk in Ontario. In order to truly protect a region, 30% of the lands and waters must be under stewardship. At the moment, Ontario as a whole has about 11%. The Thousand Islands Watershed region is at 5%.

“To permanently protect land in the Thousand Islands Watershed region through acquisition or conservation agreements, and to achieve good land management through stewardship agreements and education.”

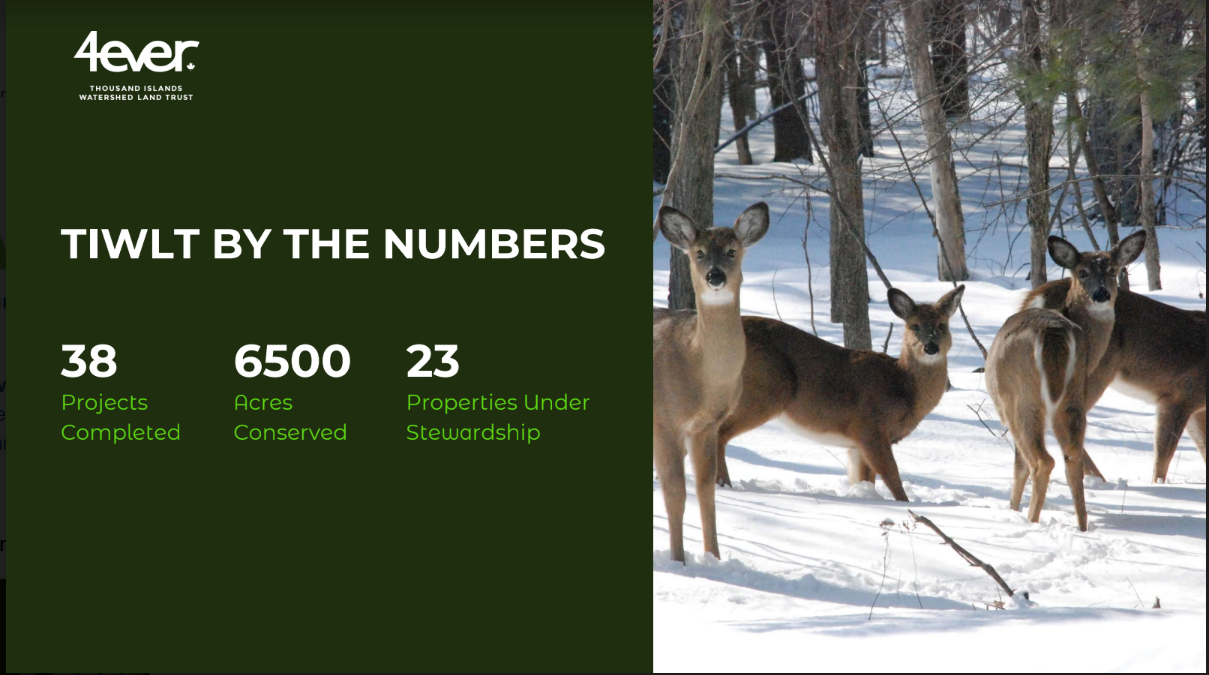

Originally formed in 1993 as the Canadian Thousand Islands Heritage Conservancy (CTIHC), which was a founding member of the Ontario Land Trust Alliance, they were instrumental in establishing the UNESCO Frontenac Arch Biosphere Reserve, one of only 18 reserves in Canada. In 2006, the organization incorporated into a larger trust under a federal charter, and became TIWLT. Since its formation in 1993, they have undertaken 38 projects, have 23 properties under stewardship (totalling approximately 2,000 acres), with 6,500 acres of land conserved.

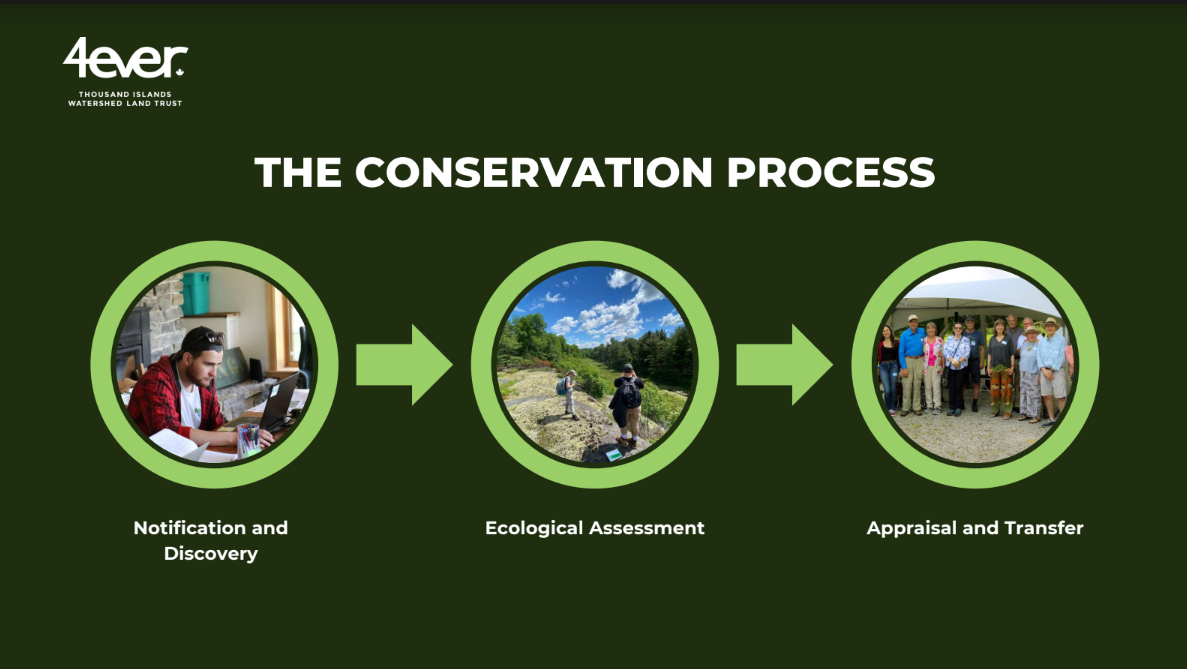

The Conservation Process

The Conservation process consists of three steps:

– Notification and Discovery,

– Ecological Assessment, and

– Appraisal and Transfer.

There is also the Ecological Gift Program, which is a Federal Government program created by CRA to recognize gifts of land to Land Trusts. This program is managed by Environment and Climate Change Canada.

The Notification and Discovery phase is led by the landowner. During this step, the possible ways to conserve the property are identified. The most commonly used option is a ‘fee simple’ donation, where the owner donates the land as a charitable gift. TIWLT then becomes responsible for future taxes. This approach may also include a Life Lease, which is exactly what it sounds like – the owner continues to live on the property for the rest of their life.

Another approach is a Conservation Easement Agreement. This agreement sets the rules for the property, protecting the land, but the owner retains title to the property. The rules follow the property title, with the Land Trust ensuring that the agreement rules are followed.

The third approach is outright purchase of the land by TIWLT. This is the rarest type of conservation for a property.

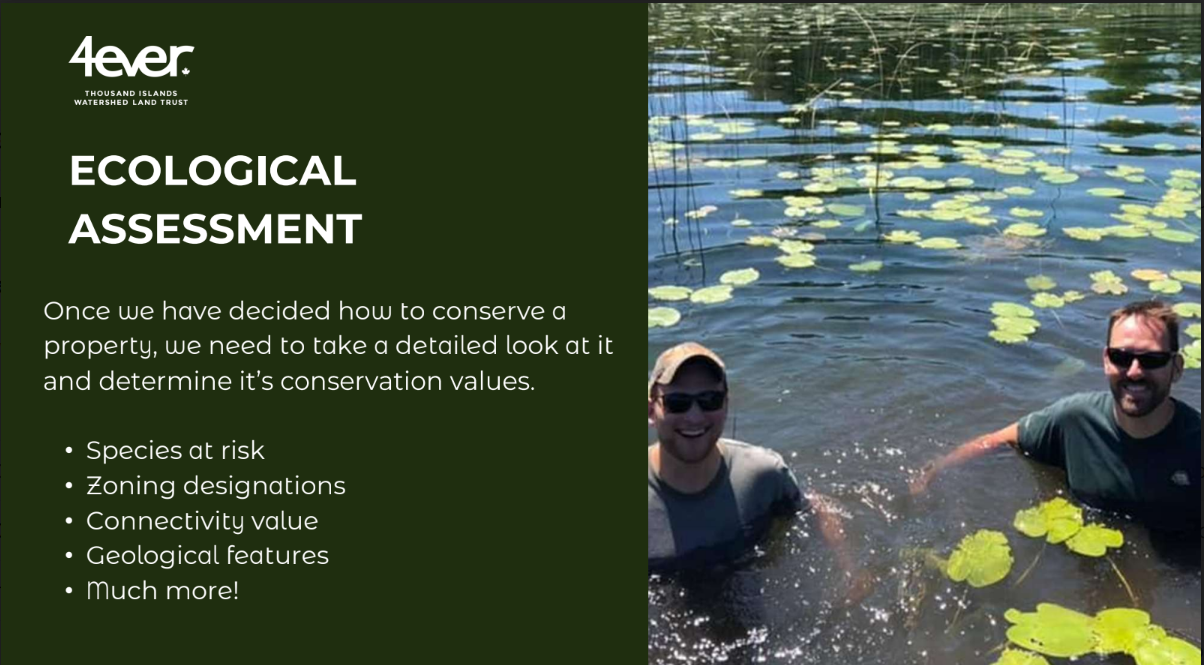

Phase Two, the Ecological Assessment, determines the conservation values of the property, for example, the number of Species At Risk, zoning design, connectivity values, geological features, etc. There are 19 primary criteria and 11 secondary ones. This is an extremely detailed assessment, which frequently results in TIWLT staff wading through swamps, tromping through pastures, fields, and forests, and identifying the resident biome. The Ecological Sensitivity Report itself tends to be 10-15 pages and takes many hours of staff time to produce. The final reports and the associated paperwork can run to hundreds of pages and the entire process of conserving a property can cost up to $20,000.

Phase Three is the Appraisal and Transfer of the property. This occurs after the Government has approved the Ecological Assessment. The appraisal is done by specialists in the field, based on the highest and best use of the property.

Tax Credits

Calder went on to briefly describe the various tax credits that could accrue to the owner, based on the type of gift. For example, for a fee simple transfer, 100% of the appraised value = 100% tax credit. In the case of a conservation easement, the tax credit = the pre-easement value minus the post-easement value. For a partial donation, the tax credit would equal the percentage of the property being donated.

There are other tax considerations as well, such as Capital Gains tax. For a gift through the Ecological Gift Program, capital gains would be 0%. Landowners need to consult their own lawyers and financial consultants, however in general, tax credits can be carried forward for 10 years. There is no limit to how much of a tax credit can be used against one’s income.

Legacies

Calder also spoke about the reasons why people donate land in the first place. Very few donors are motivated by the tax credits and financial incentives. Most are driven by a love for their land and for the area, and TIWLT honours their generosity by helping them to turn their land into a living legacy for the future.

Panel Discussion

The final part of the seminar was a panel discussion. The panel members were: Calder Schweitzer (Executive Director, TIWLT); Kelly Allin (accountant – formerly Durand and Associates, new name TBC); Georgina Ratcliffe (Realtor, Chestnut Park Real Estate Limited); Ian Attridge (Lawyer and Law Professor at Trent University); Karen Brown ( Chair of the Leeds-Grenville Stewardship Council)

A wide variety of topics were raised, many of which were financial in nature. Some of the questions posed, with brief answers, follow:

Q: Would TIWLT accept a property as a capital asset (i.e. not for conservation), which it could then sell to raise funds?

Each donation of this type is different and would be handled on a case-by-case basis. We have accepted such gifts in the past, so it’s a valid option for those who may be interested in this approach.

Q: What about donation of stocks/shares? Would this generate a tax credit for the donor?

Yes.

Q: How do Americans who own Canadian property get US tax credits for their property?

The American Friends of Canadian Conservation, which is a 501(c)(3), is a means for a US citizen who owns Canadian property, to receive US tax credits for the donation of Canadian property. The US owner donates the Canadian property to American Friends, who holds it for one year, then transfers the property to a Canadian organization, i.e. TIWLT. This type of transfer also works for easement agreements.

Q: Do the assessments for an easement agreement go back to MPAC for property reassessment?

They don’t have to, but they can. It’s an informal process and up to the property owner.

Q: Are market appraisals done on these properties?

For Fee Simple donations and Conservation Easements, the ecological appraisal is used. For purchase projects a regular appraisal is done.

Q: If a property is severed, so that part of it is conserved, is this a special process or severance?

No, severances follow current laws, there isn’t a special ecological severance. Usually, this is done using an easement, rather than actually severing the property. However, some Ontario counties may recognize conservation severances. There are also opportunities to sever natural areas from a property and then donate them separately, but such severances in this area must follow the severance rules set out by the municipality.

Q: How do you know if there is a conservation easement on a property?

Such an easement should show up on a title search of the property.

Q: How is the tax credit for a conservation easement calculated?

The property is appraised at its highest and best use, then appraised again as if the easement were already registered. The difference between those values is the basis for the tax credit.

Q: How do I find out the Canadian/Ontario criteria for assessing ecological sensitivity?

For those interested, type “assessing ecological sensitivity” into Google to bring up the Ontario/Canadian criteria for assessing ecological sensitivity. The Ontario-specific criteria are approximately 1/3 of the way down the page.

Q: How does TIWLT cover the cost of taxes lands that it actually owns, if it’s a not for profit organization?

To cover property taxes, we are eligible for the Conservation Land Tax Incentive Program which reduces property tax on qualifying ecological land under private ownership. Otherwise, property taxes come from our operations budget.

TIWLT also holds a fund that is 10% of the value of the properties, which is used exclusively to cover emergencies on the properties, such as significant ecological damage or litigation. TIWLT is required to have annual audits, which are available on request. There are also approximately $3 million in assets, which is the value of the land owned by TIWLT, but those properties can never be sold.

Don and Calder closed the seminar by thanking everyone for attending, and also inviting everyone to attend TIWLT’s annual fundraising event on August 24th. See the details at:

https://tiwlt.ca/event/celebrate-4ever-its-your-backyard-tiwlts-annual-fundraiser-event/

Find out more about TIWLT on their web site: https://tiwlt.ca/

By Elspeth Naismith

Elspeth Naismith grew up in Gananoque, graduated from McMaster University in Hamilton (B.Sc (Bio)), and then from Centennial College as an RN. She also joined the Naval Reserve (thanks to a high school chum), and after spending time on both east and west coasts, she took a break from nursing and accepted a 3-year posting to National Defence Headquarters in Ottawa. The "break" turned into 25 years, and included jaunts to East Germany, Wales and the Irish Sea, and Bosnia. She retired from the Navy in 2011 and moved back to Gananoque in 2013.

[P.S. from the editor: Elspeth leaves her mark on all TI Life articles, as she is the "Real Editor", "Comma Queen" and "overall lifesaver"!]